Much attention on retirement planning concerns money, and as we get closer to a typical retirement age it is harder to add to our pension pot. So we continue in work, which is good for our mental health and bank balance but may mean we can’t have the retirement that we had dreamed of.

I’ll be writing another article about working after 60, including changing jobs and job search. I’m the author of Find Work at 50+ so I do know about this!

You’ll need to discuss financial matters with a professional. It’s also worth getting a review from Money Helper (previously known as Pension Wise). The appointment is free and available for anyone aged 50 and over to discuss pension options. I’m based in the UK, sop can only speak for what happens here.

You may be fortunate to have a final salary pension scheme, (now called a defined benefit scheme). This can provide an index linked pension and lump sum, usually with dependents benefits. For many though it is a defined contribution with uncertainty over pension levels.

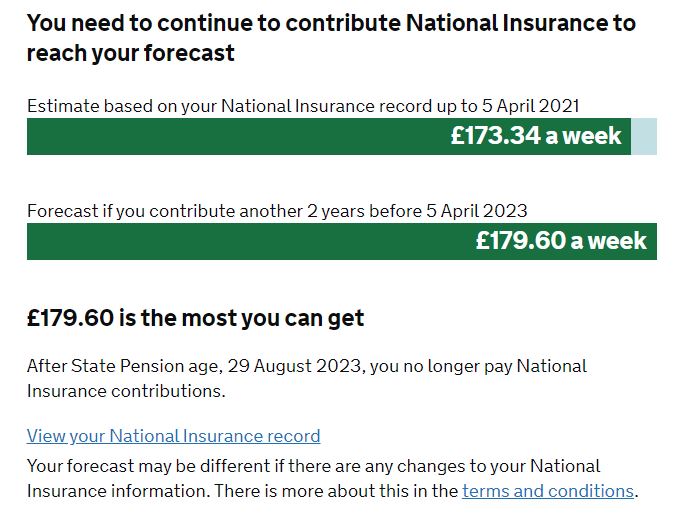

We do have some certainty with the State Pension. At 64, I’m less than 2 years from receiving mine. I regularly check this out and it is easy to do so from the Government Website.

As you can see below, I’m on target for over £9,000 per year . Not enough to live on, but if this is your only source of income there are likely to be other benefits available to you.

Despite starting work at 15 (my birthday is the end of August) I still need to continue to work (or make voluntary contributions) till my birthday to get this full amount. You are also told how much you will get if you stop making contributions.

If you decide to stop working before your state pension age you can still get credits. You may get them via another job, credits due to illness or caring, you can pay a class 3 stamp if you become self-employed or make a voluntary contribution of around £14pw. A retired police inspector friend of mine had no idea of this till we spoke, having retired in his early 50s he paid several thousand to cover his missed payments.

The WASPI Women

Until recently women would receive their state pension at 60, but now many must work till 66 or older.

It’s not great to know you will get £40k of state pension less than you expected. Many women had planned to leave their job at 60 or perhaps a few years older, especially if they could receive their occupational pension, BUT most do not realise that you still need to contribute to your state pension. If you don’t continue to make these payments you will not get your full state pension. So the guidance above will be helpful to you.

Child Benefit

Not everyone claims child benefit. If their income is too high it’s not payable. BUT YOU STILL NEED TO REGISTER. This means that if you take a career break you will still get NI credits and this can also cover you if you are looking after grandchildren.

Choices

Getting an idea of how much pension you will have from personal pensions and state benefits enables you to plan for the future. But things change. Illness may mean that you can’t continue in work. Your job may be made redundant and you move to less well paid work. There could be changes in your personal life. Divorce is rising fastest in the over 60s (silver splitters). Information will enable you to make the right choices for you and your situation.

Comments/ Questions?

Questions

- Did you get any suprises when you checked your state pension forecast?

- Has this article prompted you to do anything different?

At 64 ¼ I’m on this journey, and I’d love to share it with you.

Brought to you by Denise Taylor